What is the National Liquefied Petroleum Gas Project?

The Project is a Public Private Partnership, through a Build, Own Operate, and Transfer (BOOT) agreement between National Gas Company (Belize) Ltd. (NGC) and the Government of Belize (GOB), to build a marine terminal at the port of Big Creek and two regional wholesale depots in Belmopan and Orange Walk.

The Project leveraged private sector technical and financial strengths/resources to build needed public infrastructure – a proven development model.

In 2019 the National Gas Company (NGC) began the construction of a 60 million dollar facility at Belize’s most appropriate deep-water port at Big Creek. The project consisted of a 1.5 million gallon storage and distribution facility at the Port of Big Creek, and two inland depots located in the central corridor and the northern regions of Belize – each with a storage capacity of 50,000 gallons.

The marine terminal was built to American Society of Mechanical Engineers (ASME) standards and has a storage capacity of 1.5 million gallons (150% of current monthly demand), and is capable of receiving a 5000 cubic meters (CBM) dedicated LPG vessel.

NGC facilities include state of the art technology with a control room, leak detection system, and fire suppression system, etc.

Commercial operations began in May 2020.

Why is this Project important for Belize?

The Project was developed to address key issues of energy supply, quality standards, and transparent pricing.

Over 83% of households in Belize use LPG for cooking, and more and more transportation needs are being met by vehicles converting to LPG as a fuel source, not to mention the need for grain drying as that industry expands.

The National Marine Terminal facilitates direct importation of LPG to Belize from the source, eliminating several unnecessary stops in the logistics chain. Previously, LPG was shipped from the US Gulf Coast to Puerto Omoa in Honduras, where the product was then trucked to Belize via Honduras and Guatemala.

How is the Project being financed?

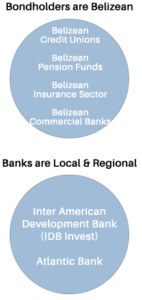

The National Liquefied Gas Project required the investment of 60 million dollars to design and build the most modern LPG infrastructure ever undertaken in Belize. 100% of the money needed for the project was provided by the private sector. This capital came from Belizean investors and one foreign investor who provided much needed hard currency. Belizeans hold the majority.

The Government of Belize holds 25% – with no money invested by the GOB. The finance charges applicable to the project commenced in January of 2021. The Bond offering was the first of its kind in Belize and uses private sector funding to develop key national infrastructure with government participation from the very beginning, culminating in full Government of Belize ownership in 15 years.

How does the Government of Belize participate in the Project?

NGC (a Chapter 206 company) is the Project Developer; 25% is owned by the GOB. At the end of 15 years, NGC will exit the Project and the GOB will then own 100% of the Project facilities (marine terminal and wholesale depots). The GOB has a seat on the Board of Directors of NGC.

Is the Project creating a monopoly?

While all the LPG entering the country passes through the National Marine Terminal, the sourcing of the LPG imports is via tender in accordance with the tendering process established in the Finance and Audit Act. Previous importers are not locked out of this importation process and are encouraged to participate. NGC is not involved in retail distribution.

How is LPG priced?

The Wholesale Pricing of the LPG is regulated by the Belize Bureau of Standards (BBS) in accordance with the Pricing Methodology established under the LPG Act which provides for a price build up based on a Landed Cost, a Financing Fee, an Operations Fee, and a Regulatory Fee.

The Regulatory Fee provides a source of funding to the BBS to support regulatory activities in the LPG industry.

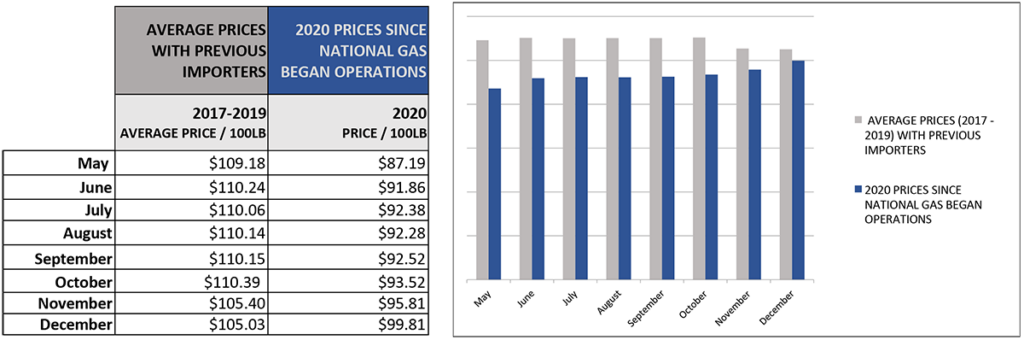

In May of 2020 NGC initiated the importation of LPG to supply gas to wholesale and retail companies throughout Belize. Since then, Belizeans have paid less per 100 lb cylinder than the average prices over the past 3 years before the National LPG Terminal was established.